Redefining What’s Possible in High-Risk Payments.

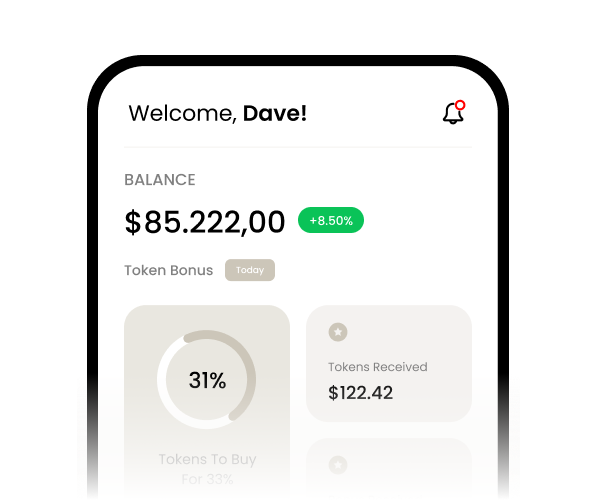

Fintoro makes payment acceptance simple for industries with unique needs. Whether you’re monetizing exclusive content, running a tokenized platform, or selling across borders, we have the rails and know-how to make it work.

Pay-In Services

(Accepting Payments).

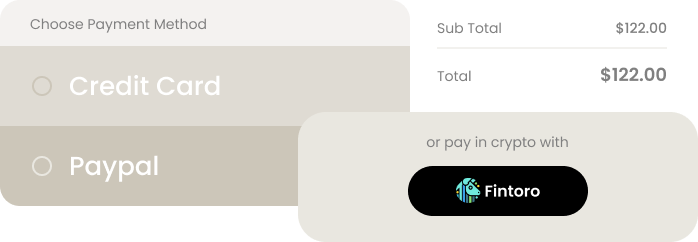

You can accept payments in the format your customers prefer — credit cards, bank transfers, crypto, or even token-based methods — all through a single, unified platform.

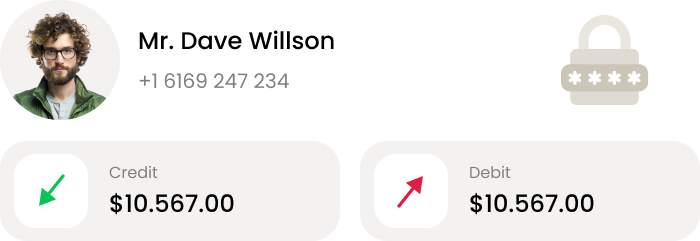

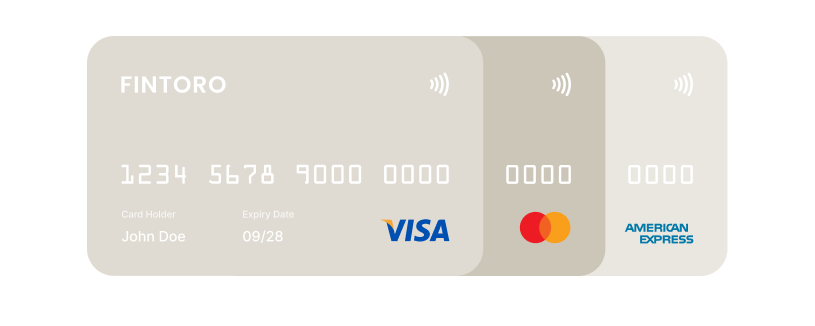

Credit & Debit Card Processing

Our full-service card processing supports all major networks, including Visa, MasterCard, Amex, and Discover. We work with acquiring banks that specialize in high-risk sectors, ensuring your merchant account remains stable even with elevated chargeback exposure. Multi-MID configurations are available for scalability and redundancy, while recurring billing and custom descriptors minimize disputes and improve customer retention.

ACH & Bank Transfers

Bank-to-bank payments via ACH and regional equivalents are also supported. This method is ideal for subscription-based businesses and high-ticket programs looking to minimize card fees. Fintoro’s ACH infrastructure offers low transaction costs, same-day settlement options, and integration tools like Plaid and micro-deposit verification to onboard customers efficiently and securely.

Real-Time Bank Payments

With real-time bank payments powered by open banking and real-time payment networks, your customers can transfer funds instantly from their bank accounts. This significantly reduces cart abandonment and accelerates fund availability, while built-in identity verification adds a layer of fraud prevention.

Crypto & Digital Currency Checkout

Fintoro also enables crypto and digital currency checkout, allowing customers to pay in Bitcoin, Ethereum, USDC, and more. You can receive settlement in crypto or fiat depending on your preference. All crypto transactions are wrapped in regulatory compliance, including KYC/AML and OFAC protocols, and come with tools for accounting and tax reporting.

Tokenized/NFT Access Payments

For Web3-aligned businesses, Fintoro supports tokenized and NFT-based access payments. If your platform offers gated services via NFT ownership or other token standards, our platform can verify and process these interactions. This feature is ideal for modern creators, communities, and fintech innovators.

These pay-in capabilities provide high-risk merchants with the flexibility, compliance, and speed

they need to succeed in competitive markets.

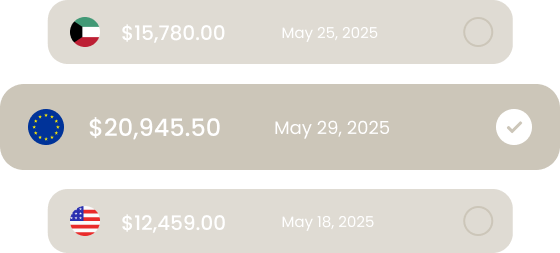

Pay-Out Service

(Sending Payments).

That’s why our payout infrastructure is designed for scale, speed, and simplicity.

ACH & Bank Deposits (U.S.)

For U.S.-based transactions, merchants can send funds directly to recipients’ checking accounts via ACH. Whether it’s a single affiliate or thousands of content creators, our ACH system supports same-day and next-day transfers. International disbursements are equally efficient, with multi-currency wires and local bank transfers across supported countries. Wherever possible, we use local clearing rails to reduce costs and processing times.

Prepaid Card Programs

Fintoro also offers branded prepaid card programs, enabling merchants to issue virtual or physical cards to their payees. These cards can be funded instantly and are ideal for creators, gig workers, and even customer incentives. Custom branding adds a loyalty component while bypassing traditional banking infrastructure.

Crypto Payouts

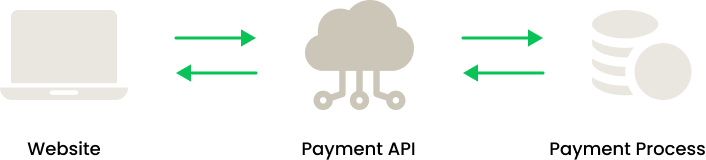

Automated Payout API

Larger platforms benefit from our Automated Payout API. This robust integration allows your developers to programmatically trigger payouts based on platform events. Features include real-time tracking, fallback logic if a method fails, and customizable compliance settings — such as holding payouts until KYC is complete. This automation significantly reduces manual work while increasing accuracy and transparency.

payout solutions scale with you.

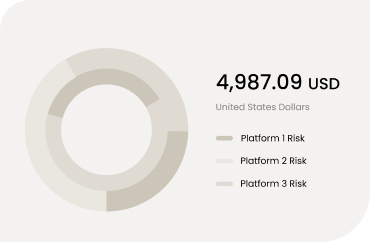

Value-Added Services & Solutions

Unlock Efficiency. Drive Revenue.

Fintoro offers more than payment rails — we deliver strategic solutions that help high-risk businesses succeed.

Streamlined Card Processing for Modern Finance.

Streamlined Card Processing for Modern Finance.

Streamlined Card Processing for Modern Finance.

Streamlined Card Processing for Modern Finance.

Integration & Support

Connect with Ease.

Our dedicated support team is here to guide you every step of the way, ensuring a smooth and seamless experience.

Developer-Friendly API

Despite offering sophisticated tools and infrastructure, integrating with Fintoro is simple and streamlined. All services — including pay-in, pay-out, and fraud management — are available via a unified API and modern SDKs. With complete documentation and sandbox environments, developers can build and test quickly.

Compliance Support & Onboarding

Compliance onboarding is made painless by our dedicated support team. They’ll guide you through KYC/KYB requirements, fraud rule configuration, and test transactions to ensure everything is ready before going live. From setup to scaling, Fintoro is there to help every step of the way.

Platform Plugins

We also offer plug-and-play modules for popular platforms like WooCommerce and Magento, as well as lightweight embedded checkouts for rapid deployment. Whether you’re running a storefront, a SaaS platform, or a membership site, Fintoro fits into your stack.

Ongoing Expertise

Our support team includes high-risk industry experts who respond quickly to issues and proactively monitor your performance. We understand your challenges and stay invested in your success.